PUMP Rallies Against the Trend: What’s Been Happening with Meme Launchpads Over the Past Two Weeks?

The “meme launchpad battle” between pump.fun and Letsbonk.fun has now stretched into its second month since early July. Over this period, we’ve watched pump.fun pull off one of the largest ICOs in crypto history, while Letsbonk.fun made a strong push for market share—ultimately exerting real pressure on pump.fun. Newer players have also entered the fray; while they haven’t caused major disruptions yet, they’re worthy of attention for anyone watching the meme coin space.

Let’s start with the Jupiter data chart below.

Letsbonk.fun has held the top spot in market share for the last seven days, but the trending narratives and activity in its ecosystem have diverged significantly from those of pump.fun.

pump.fun: The PVE Narrative Returns?

On July 24, after a live interview with threadguy, pump.fun and its founder @a1lon9 went nearly two weeks without any public updates. At the time, the interview was widely seen as a PR disaster that tanked the token: $PUMP dropped almost 15% during the livestream, plunged nearly 20% for the day, and briefly fell below a $3 billion market cap.

(Related: The livestream that drove pump.fun below its launch price)

Since that event, the market share gap between pump.fun and Letsbonk.fun has remained mostly unchanged. However, beginning July 30, sentiment toward pump.fun has made a marked recovery.

The key reason: pump.fun ecosystem community coins performed well despite wider market instability.

The image above, posted by pump.fun’s official Twitter on July 23, showcases several ecosystem meme tokens that many consider “official selections.” Of these, $TROLL has been the star, rallying 9x since July 25 and surpassing a $100 million market cap. $Tokabu surged up to 5x within the same period, peaking at $35 million. $USDUC doubled and nearly reached $40 million market cap. $CHILLHOUSE and $neet, with growth similar to $USDUC, briefly hit market caps close to $30 million and $18 million, respectively.

Among these, the newer tokens have shown consistent momentum since July 25; only “streamer tokens” and older coins like $FWOG and $michi—those with already substantial market caps and histories of over 300 days—missed out on the latest rally.

What’s driving the upside for these “new tokens”? Nothing dramatic from the official team—pump.fun and alon remained silent until just two days ago. Narratively, these “new tokens” sustained active output and vibrant community engagement during pump.fun’s darkest days, maintaining the platform’s vision for meme coins with true staying power.

The first concrete move from pump.fun’s official team came just two days ago with the unveiling of a $PUMP buyback dashboard.

“Over the past 6 days, we’ve bought back about $PUMP worth 8,740 SOL, or 102% of our revenue for the period.”

Early this morning, pump.fun’s official Twitter updated its banner to once again promote its “officially selected” meme tokens:

Interestingly, in the aftermath of the July 24 livestream, nearly all of the meme tokens acquired by pump.fun’s founder were deeply underwater. Now, the portfolio is back in the green—and by substantial margins:

For meme coin markets to recover, the first step is restoring user confidence. Belief that meme coins can be more than a scheme—that strong narratives, quality content, vibrant communities, and sustained operations can allow a meme coin to break out. While these tokens’ performance bears ongoing observation, for now, it looks like a promising new chapter—if the momentum holds.

Going forward, pump.fun still has plenty in reserve—including airdrops and livestreams. But it’ll be a long road: With Binance, OKX, and other major exchanges nearly stopping new Solana meme coin listings, pump.fun will have to innovate to stay relevant.

Much remains to be done.

Letsbonk.fun: “Home for New Tokens” Hits a Short-Term Plateau

Letsbonk.fun has retained over 50% market share over the last week, holding the top spot. The recent surge in pump.fun’s attention is mainly due to the strong showing from “recent” tokens, rather than buzz around brand-new launches driving discussion.

In the last stretch, most “hot” tokens—like $Ani—have launched on Letsbonk.fun. The successful path that once belonged to pump.fun now leads through Letsbonk.fun.

Meanwhile, major Letsbonk.fun tokens have faced sharp corrections. $USELESS dropped from a $400 million high to around $200 million, $memecoin fell from nearly $60 million to $11 million, $Bluechip tumbled from $17 million to $1.5 million, and $Ani from $86 million to about $30 million.

BONK and GP have also fallen 36% and 63% from their peaks, respectively.

Despite weaker price action, Letsbonk.fun remains committed to buybacks and ecosystem support for meme tokens. Rather than a direct rivalry between Letsbonk.fun and pump.fun, it’s more a case of both grinding away toward their own goals. Only when overall market confidence in meme coins returns can both truly thrive.

Let’s see what Letsbonk.fun does next.

Bags and Moonit: Old Platforms, New Moves

Bags started out as a social trading app, rolling out its token launchpad feature on May 22. Moonit, a spin-off from Helio, launched its platform at the end of April this year.

Bags recently drew attention for its “donation-driven narrative.” $CANCER pledged 100% of trading fee revenue to Susan G. Komen, a leading and influential breast cancer charity, donating $35,000 so far and transferring about 2.2% of all $CANCER to the organization.

What’s unique about Bags is that tokens launched there can direct creator trading fee revenue to any Twitter account. For instance, $WINRAR routed all income to the official WinRAR Twitter, prompting a reply from the app’s account.

But these tokens faded as quickly as they spiked—their values have now crashed. At present, Bags has no clear leader either in attention or market cap.

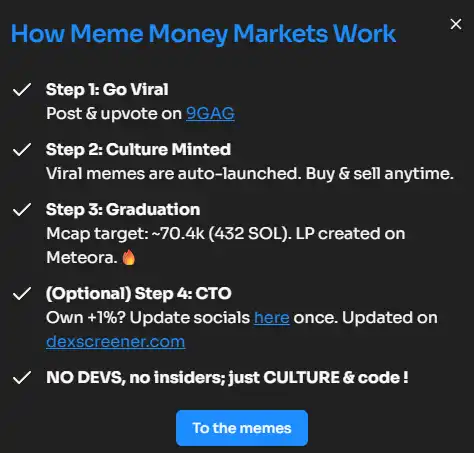

Moonit, meanwhile, is playing a bigger game. Its new AI protocol, co-developed with 9GAG, Memeland, Helio Pay, MoonPay, and Dexscreener, can automatically tokenize online culture and viral memes.

Basically, the protocol uses AI to recognize popular memes on 9GAG and auto-launches tokens based on these trends—effectively “auto-listing trending 9GAG coins.” This strategy is mainly centered on 9GAG for now. If integration with platforms like Tiktok, Instagram, or Twitter were possible, we’d likely see similar products emerge.

There are still hurdles to clear. First: technology alone doesn’t guarantee liquidity. With so many devs in the space, a viral meme triggers a rush of new tokens—whether any given coin can build consensus comes down to platform liquidity.

Second: ongoing sustainability. Bringing the 9GAG community on-chain could be compelling. But as shown in the slide above, step 4 is “CTO”—if even trending 9GAG memes need a technical lead, it suggests a weak community foundation and an unrealized advantage.

So far, Moonit’s new feature hasn’t yielded a breakout leader.

As the number of launchpads grows, the core challenges aren’t getting any simpler.

Conclusion

The meme launchpad competition isn’t ending anytime soon. Pump.fun’s remarkable success over the past year has everyone wanting a piece of the action, but the big question remains—how to rekindle market enthusiasm and trust in meme coins?

With centralized exchanges largely sidelining new meme listings, the key will be building better on-chain infrastructure and liquidity to revive the meme coin sector.

In the end, it’s less a war and more a test for every launchpad. The warning from the inscription craze is clear: tooling keeps improving, but hype can vanish overnight.

Hopefully, the ultimate beneficiaries will be the whole meme coin market—and all the crypto traders who still love memes.

Disclaimer:

- This article is republished from [BlockBeats]. Copyright remains with the original author [Cookie]. For republishing concerns, contact the Gate Learn Team, who will resolve issues through official channels.

- Disclaimer: The opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn Team. Do not copy, distribute, or plagiarize these translations except where Gate is expressly credited.

Related Articles

Top 10 Meme Coin Trading Platforms

What's Behind Solana's Biggest Meme Launch Platform Pump.fun?

NFTs and Memecoins in Last vs Current Bull Markets

Review of the Top Ten Meme Bots

Introduction to Raydium