The 70x Meme Coin Collapsed — Can the DeFi IMF of Meme Tokens Make a Comeback?

Between early June and early July this year, $IMF—one of the leading MemeFi projects on Ethereum mainnet—soared nearly 70x at its peak. While $IMF retraced by about 50% after hitting an all-time high market cap of $70 million, just yesterday, a staggering drop of almost 85% resulted in significant market volatility.

Zhu Su was stunned by the sharp decline in $IMF

What triggered such a massive decline in $IMF?

What is IMF?

IMF (International Meme Fund) is a decentralized finance platform uniquely tailored for mainnet meme tokens. It enables users to use meme coins like $PEPE, $JOE, and $MOG as collateral to borrow the stablecoin $USDS, providing liquidity without needing to sell their assets. Through modules such as Accelerate and Amplify, projects or whales can engage in leveraged trading, recursive borrowing and lending to support prices, or even create the appearance of “token lock-ups” while actually facilitating early exits and opaque fund management.

IMF supports recursive meme coin lending, allowing for “self-reinforcing” strategies. For example:

· Purchase $10,000 in PEPE

· Deposit PEPE into IMF, then borrow $5,000 in USDS

· Convert the USDS back to PEPE

· Deposit the remaining $5,000 worth of PEPE to lower the loan-to-value (LTV) ratio

As of now, IMF’s total value locked (TVL) stands at approximately $166.5 million, with about $54 million in $USDS deposited, alongside $29.22 million in $PEPE, $20.58 million in $stETH, $44.40 million in $MOG, $5.88 million in $JOE, $4.94 million in $SPX, and $7.5 million in $IMF used as collateral.

Why did $IMF crash?

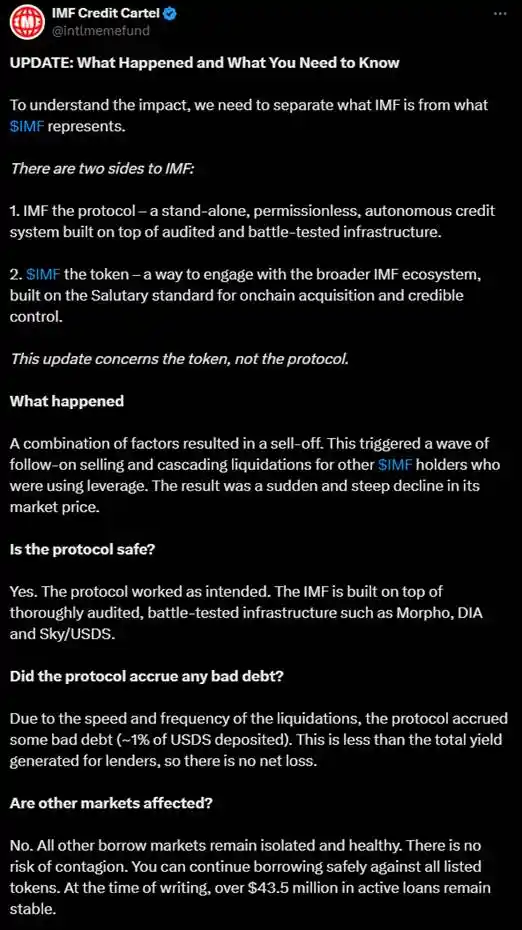

According to official IMF posts on X, the sudden crash wasn’t due to a protocol vulnerability but rather high-volume sell-offs of the $IMF token, which triggered a wave of sell-offs and cascading liquidations—leading to a steep price decline.

The official statement also confirmed that rapid and frequent liquidations resulted in some bad debt equivalent to approximately 1% of USDS deposits, but this was still less than the total returns generated for lenders, meaning there was no net loss. Additionally, problems with the $IMF lending market did not impact any other lending pairs on the platform.

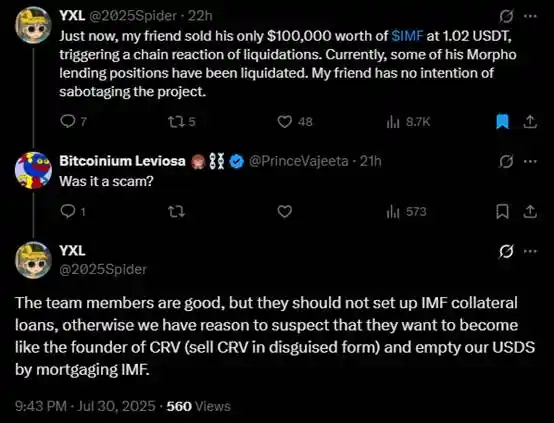

@2025Spider posted that his friend sold $100,000 worth of $IMF at $1.02 per token, triggering a chain reaction of liquidations. He emphasized that his friend did not intend to damage the IMF project. He argued that the team should close IMF lending positions—otherwise, USDS would be at significant risk. He also criticized the team’s slow oracle updates: even after most IMF/USDT positions were underwater, the oracle had not updated to reflect up-to-date prices.

Both @2025Spider and Chinese crypto influencer “Professor Suo Says” called into question the practice of allowing IMF’s own token to be used as lending collateral:

In replies to @2025Spider, some asked: “Is IMF a scam?” @2025Spider responded that while the team members are solid, permitting $IMF as collateral gives an opening for concerns—similar to how CRV’s founder sold tokens for liquidity. He also noted that available IMF loan amounts exceeded the size of the IMF UniSwap pool. From a risk management perspective, this is irresponsible.

“Professor Suo Says” used on-chain data to directly allege that the IMF team staked its own tokens to drive FOMO before liquidating their positions:

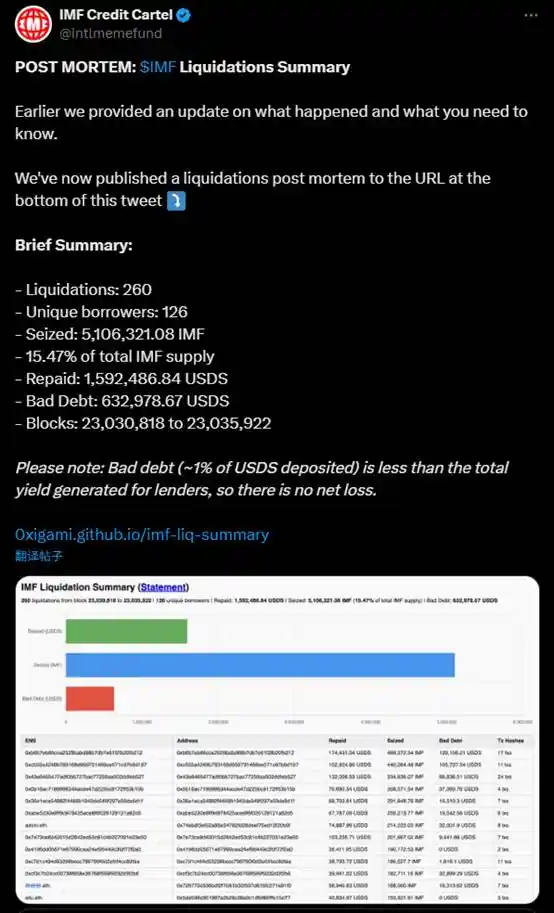

Earlier today, IMF’s official X account released a detailed report on the cascade liquidation event. There were 260 liquidation events affecting 126 distinct borrowers, accounting for 15.47% of the total IMF supply liquidated.

Conclusion

Following the incident, $IMF rebounded by nearly 400% from its lowest point. It is now trading at almost 200% above the bottom, bringing its market cap back to roughly $21 million.

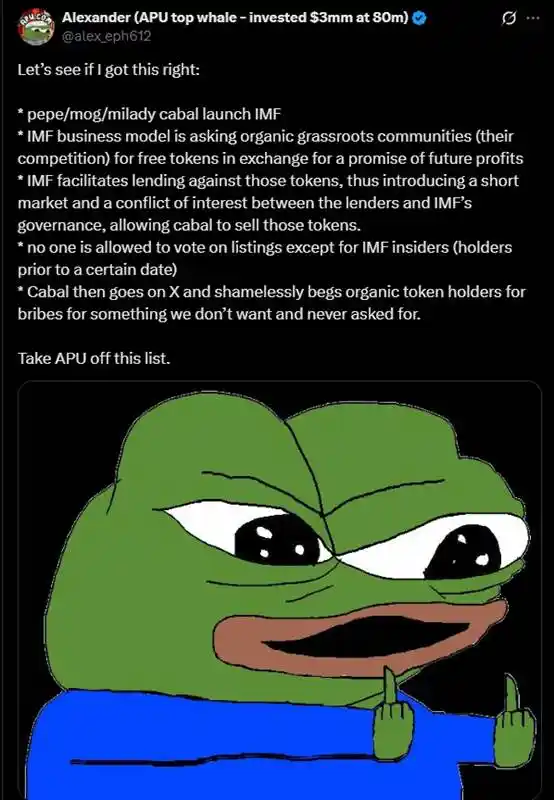

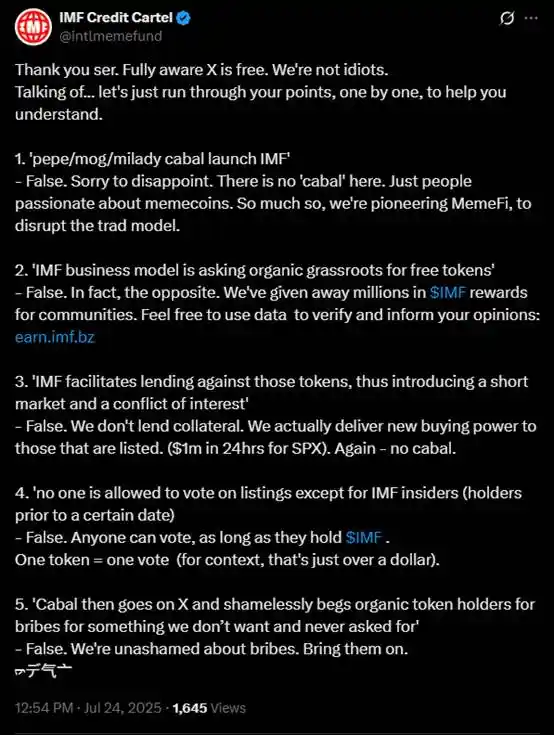

Still, the controversy around $IMF is likely far from settled. On July 24, Ethereum’s top $APU holder, @alex_eph612, openly criticized IMF. He alleged that IMF was the brainchild of a coalition behind $PEPE, $MOG, and Milady, and that its model is to solicit free tokens from other meme coin communities in exchange for short-term buying pressure—only to dump those tokens later for profit:

IMF promptly responded, stating that it had never solicited bribes and that standards for listing lending pairs are publicly disclosed and subject to $IMF holder votes:

The Ethereum meme token ecosystem remains volatile.

Disclaimer:

- This article is republished from BLOCKBEATS, and the copyright belongs to the original author Cookie. If you have concerns about the republication, please contact the Gate Learn Team. We will address your inquiry promptly via standard procedures.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn Team. Do not copy or distribute this translated article without crediting Gate.

Share