The Rise of Pendle PT: From DeFi Experiment to Fixed-Income Empire

In the past three to four years, the crypto world’s hottest narratives have shifted rapidly: the Ethereum Merge ignited the LSD sector, airdrop incentives triggered a leaderboard frenzy, and now stablecoin yields are the latest focal point. Constant excitement is the norm, but after each hype cycle fades, Pendle remains at the center of the stage—not loud, but steadily expanding and reinforcing the infrastructure behind the scenes.

To put it differently, Lido provided liquidity and Rocket Pool drove decentralization during 2023’s LSD boom, but Pendle was the sole provider of yield splitting and pricing. In 2024, when airdrop hunters track points in Excel and race on Twitter, it’s still Pendle that transparently lists “future yield” through YT. By 2025, as stablecoin market caps keep climbing and yield-bearing dollars become the narrative backbone, Pendle stands as the largest secondary trading venue. Three cycles, one underlying theme—those who master the on-chain “modularization” of yield will secure their place in the next narrative wave.

From USDT to PT: Stablecoins and Fixed Yield Creating Dual Momentum

Today’s stablecoin dialogue isn’t just about legacy giants like USDT and USDC; it’s about newcomers such as USDe and cUSD0 that come with yield. The data is clear: over the past month, Pendle’s TVL hit a new stride—peaking at $8.2 billion on August 9 and then nearly $9 billion by August 13. More importantly, capital is cycling back in: this week, Aave quietly raised the PT-USDe (Sep 2025) cap by $600 million, which filled in under an hour. This confirms that institutional and whale demand for PT remains robust and even stronger than before.

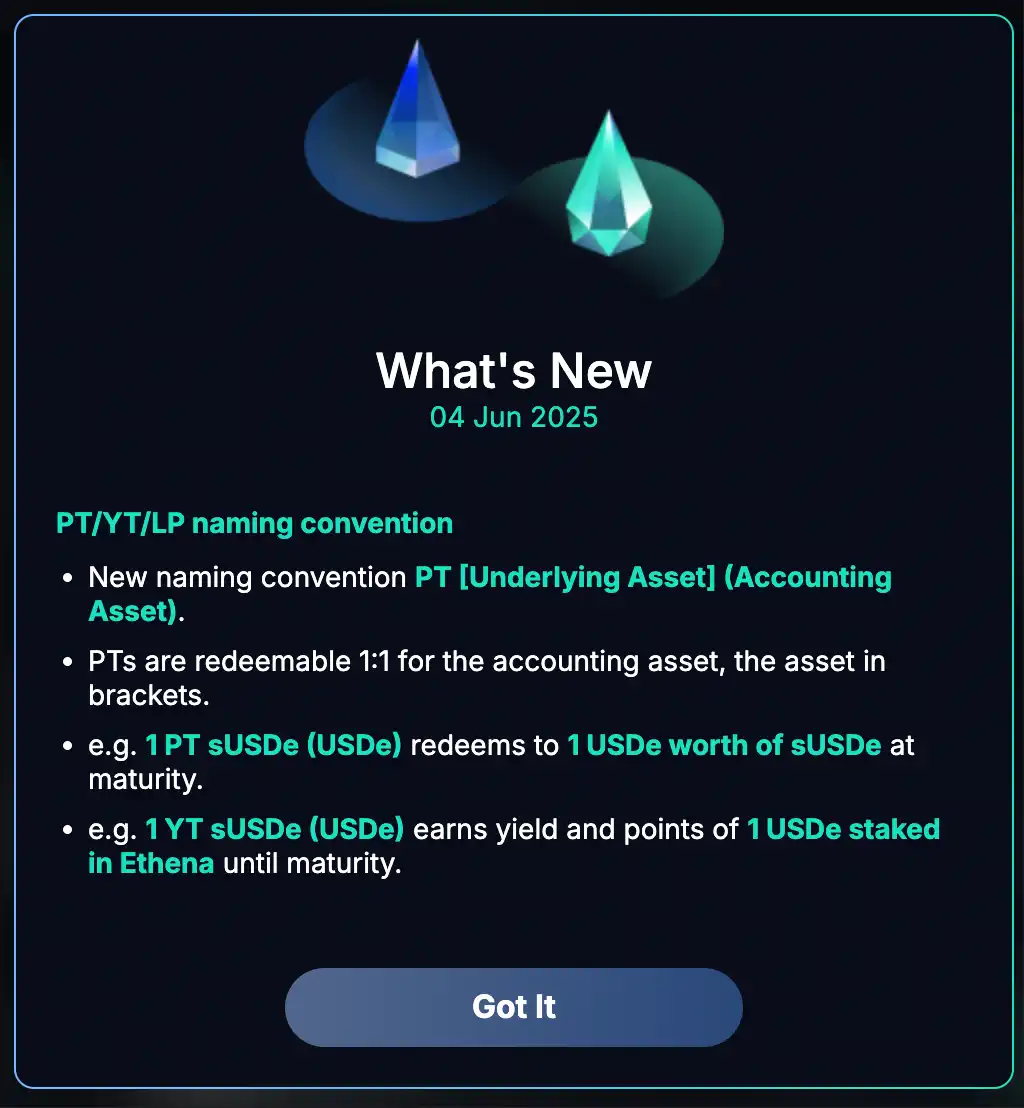

Many still view Pendle as an “airdrop rewards hub,” but its focus has evolved. Since June, PT/YT have adopted more intuitive labeling on the front end, clarifying: “1 PT redeems principal at maturity; 1 YT accrues all yield.” This makes it easy for newcomers to understand—no Telegram help needed. The platform now includes daily pop-up notifications detailing position changes and realized yield as soon as users log in.

In TradFi, Citadels and Edge Capital partnered together. This $400 million hedge fund has packaged its mEDGE strategy vault as PT and deployed it on Pendle, with mEDGE’s TVL surpassing $10 million. At the same time, Spark’s USDS stablecoin saw over $100 million in 24-hour inflows, with Spark’s 25x reward multiplier pulling in a wave of yield farmers and boosting USDS TVL on Pendle beyond $200 million. The lending ecosystem is also thriving, as total circulating PT on Aave has broken several billion dollars—fixed yield is truly “turning into money.”

Why PT Outperforms in Volatile Markets: The Liquid Leverage Example

On July 29, Ethena launched Liquid Leverage on Aave, allowing users to supply 50% USDe and 50% sUSDe as collateral—combining borrowing rates and promotional incentives for a more “market-oriented” approach to yield. On launch day, some wondered if this would cannibalize PT. The outcome was the opposite: Aave’s increased PT-USDe cap was instantly filled. Liquid Leverage yields partly depend on ENA ecosystem rewards, making them more sensitive to market and campaign intensity, while PT returns are set by discount, minimizing volatility exposure. Simply put: LL is the “energy drink”—aggressive during promotion—while PT is “plain water plus a savings account”—steady after the promotional rush ends.

Citadels: Turning DeFi Fixed Income into an Empire

In a nutshell, Citadels is Pendle’s expansion plan: bridging traditional capital and new blockchains. Regulation, KYC, RWA, Solana, TON—while these may sound complex, the core logic is simple: bring PT/YT yield modularity to more environments, pricing any on-chain yield asset through Pendle. If Pendle used to be a side quest full of tasks, Citadels is about building a financial empire at the core—anyone wanting to issue a stablecoin, launch an RWA, or create rate-hedging products needs to list here first.

Institutional PT and Cross-Chain PT: Where Do We Go Next?

Pendle’s Citadels isn’t just a “rebranded homepage;” it comprises three authentic distribution channels:

(1) Non-EVM PT deployment: instantly expanding PT to ecosystems like Solana, TON, and HYPE to reach new user and asset segments;

(2) KYC-compliant PT: wrapping on-chain fixed-income as “compliant” assets for institutional wallets and broker connections;

(3) Direct strategy distribution: as with Edge Capital’s mEDGE, which has directly minted its repository as PT on Pendle—bridging institutional strategies and DeFi fixed income. The upshot: one PT, two growth paths (cross-chain and institutional), delivering “yield composability” to many new front ends.

Why the Pencosystem?

Pencosystem: The Impact of Modularizing Yields

For protocols, Pendle is much more than a tool for “turning yield into tokens.” It acts as an engine that amplifies TVL, liquidity, and real-time price signals in sync. Once a pool is listed, single-sided liquidity provision with zero impermanent loss (if positions are held to maturity) keeps LPs engaged; the PT discount and YT premium together operate as a live price discovery dashboard, letting teams instantly gauge external capital sentiment. EtherFi is the poster example—after eETH went live on Pendle, its protocol TVL jumped 15x in under six months, while OpenEden, previously stagnant, increased 45% after listing. Bottom line: when Pendle thrives, its underlying protocols benefit as well.

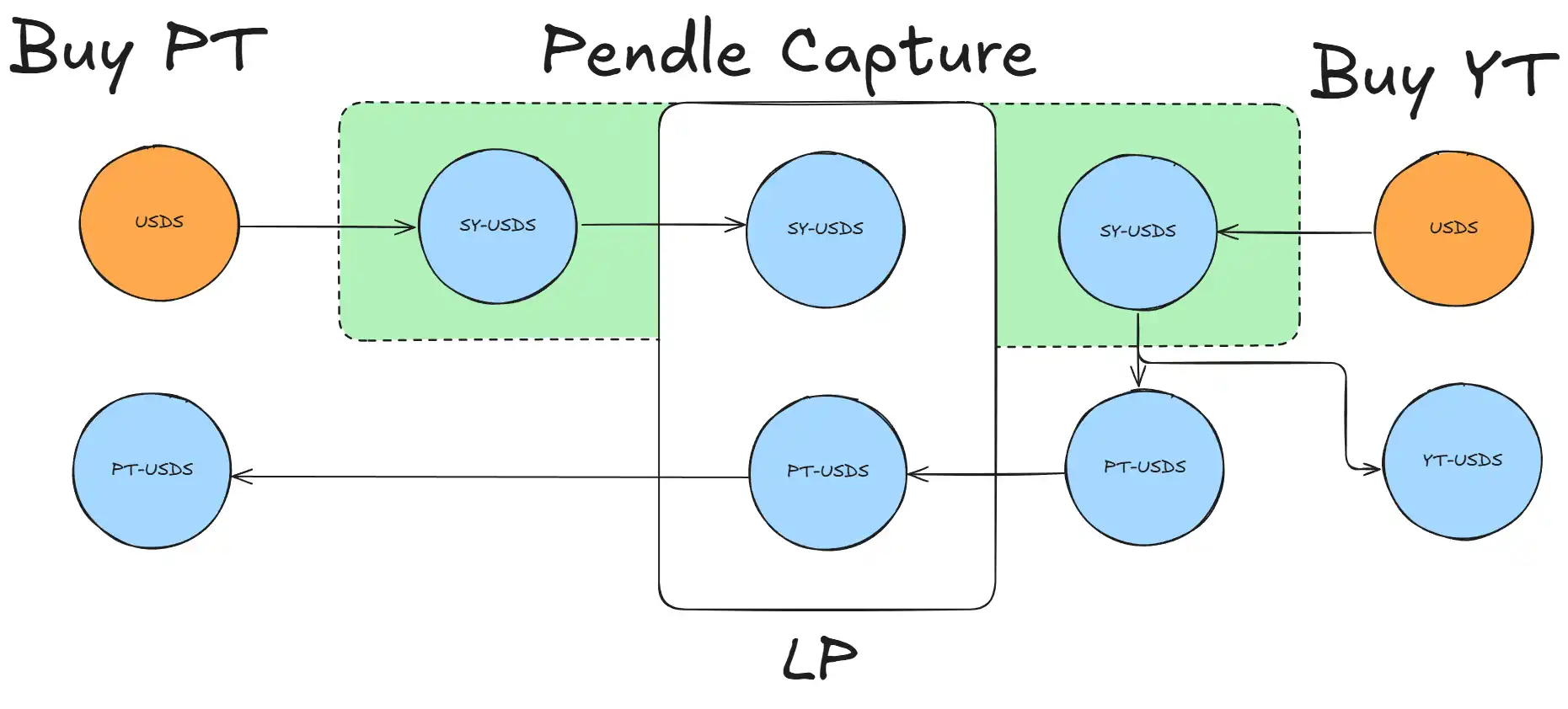

Pendle’s innovation is straightforward: slice a yield-bearing asset into fixed and variable yield. PT functions like a one-year U.S. Treasury—stable returns of 3–12% APY at maturity—while YT is for those betting on airdrops, Fed rate moves, or funding rates. Once split, the market arbitrages the spread: the deeper the PT discount, the more attractive the fixed yield; the higher the YT premium, the more bullish the market is about future upside.

This decomposition is powerful: LPs can earn fees by providing only one side, face negligible impermanent loss, and use PT to access leverage on Aave. Large participants often 3-5x their leveraged APY to achieve 25–30% yields, all transparently on-chain and reproducible by even TradFi analysts using Excel templates.

Since late 2023, Pendle has facilitated 27 major maturity events, including seven with over $1 billion each. The biggest, $3.8 billion, was settled instantly on-chain last June. More recently, $1.6 billion matured on May 29, with TVL dropping from $4.79 billion to $4.23 billion before rebounding to $4.45 billion in a week—a 93% retention rate. This capital isn’t just returning by luck—35% of matured funds rolled straight into new Pendle pools, the highest seven-day retention rate on record.

Stablecoins’ Launchpad

Stablecoins are the most direct and most rewarded participants in the Pendle story. PT tokenizes 3–12% fixed annualized yield on-chain, while YT bundles future rates, airdrop rewards, and funding rate “event risk” for speculators—so new stablecoins launch with two tracks: stable income and high-volatility speculation.

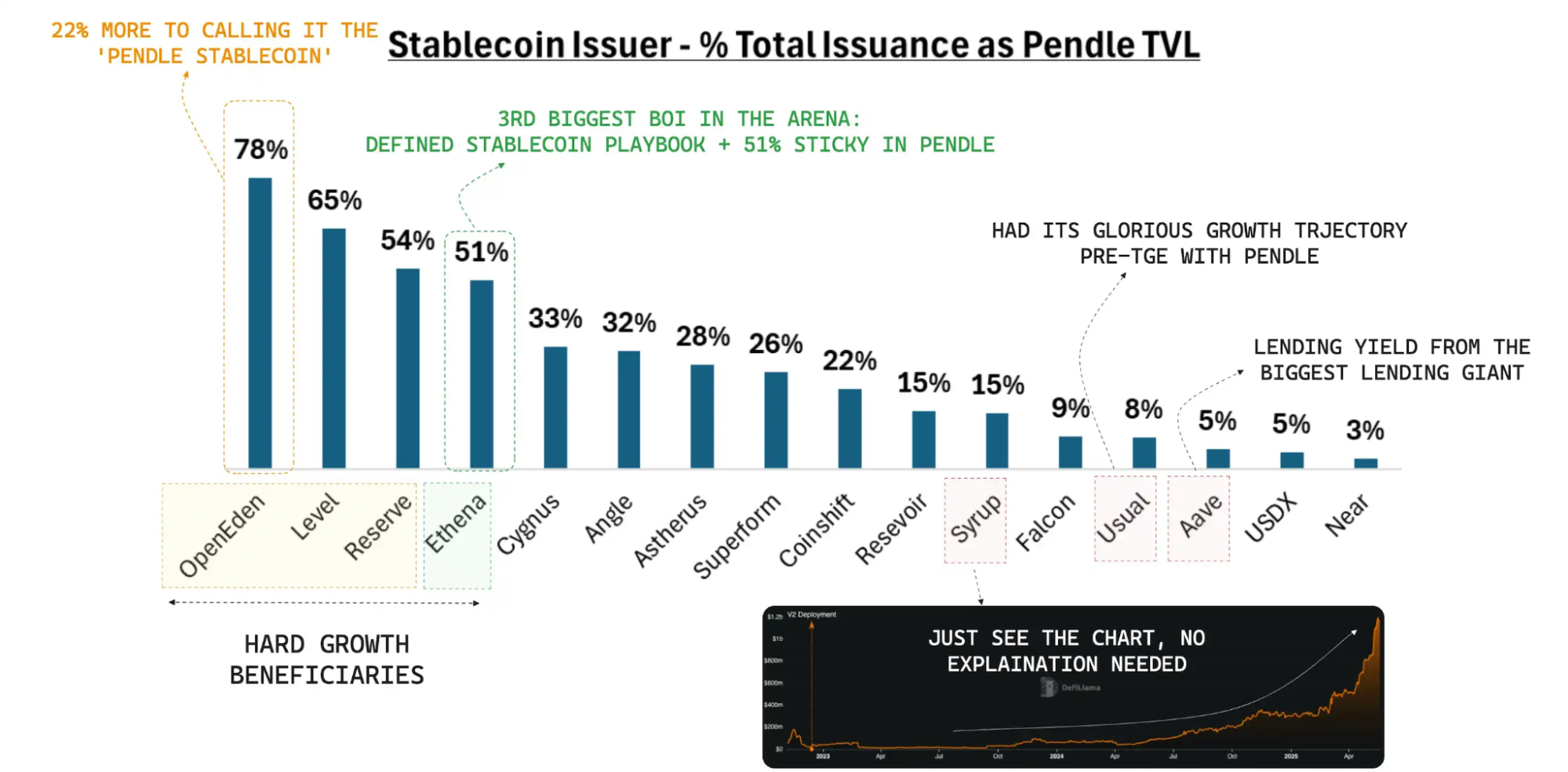

The proof is in the data: before USDe hit $1 billion TVL, half was locked in Pendle, and even at nearly $6 billion it maintains a 40% share. cUSD0 was flat for three weeks but grew 45% in its first month on Pendle. Newly listed USDS attracted $100 million in just 24 hours. Liquidity retention is equally impressive—during the $1.6 billion maturity on May 29, USDe’s TVL dropped just 6% and recovered in four days. For any stablecoin, “capital stickiness after a liquidity event” is a major draw for institutional treasuries.

In the past year, boosting TVL has made the “Pendle Pool” a standard feature in the launch playbooks for yield-bearing stablecoins. OpenEden’s cUSD0, which had been stagnant, grew 45% in less than a month on Pendle. Launching a new stablecoin typically means entrusting price discovery and initial liquidity to Pendle—it’s now the default move.

Zooming out, the stablecoin sector is undergoing structural expansion. Modular Capital’s Pendle: Era of Stablecoin Expansion reports global stablecoin supply has surpassed $250 billion, with yield-bearing stablecoins increasing from under $1.5 billion to $11 billion in 18 months, and their share rising from 1% to 4.5%. The same report projects that with the GENIUS Act and persistently high Fed rates, the next 18–24 months could see supply double to $500 billion, with 15% ($75 billion) flowing to yield products.

If Pendle keeps its roughly 30% market share, its TVL could climb to $20 billion, generating an annualized $200 million in revenue at a 100 basis-point fee. Modular Capital concludes that Pendle in DeFi fixed income could “anchor its valuation with both Treasuries and NASDAQ growth stocks.”

PT: Evolving into an Economic Corridor

Currently, more than 80% of Pendle’s TVL is comprised of U.S. dollar assets, performing in both bull and bear markets. PT supply across Aave, Morpho, and Euler has doubled in six months, breaking above $2 billion. More LPs are now rolling maturing LP into new terms, accelerating TVL inflow.

Since July 29, PT’s annualized returns have consistently outperformed the “lend-and-arbitrage” model for two reasons: first, PT coupons lock in yield at a discount, insulated from the borrowing side’s liquidity and promotional swings; second, PT can be used as collateral for leveraged looping in money markets, generating “fixed yield × leverage” returns that rival traditional collateral. Aave’s latest risk report shows PT as collateral grew to multi-billion dollar levels within just over a month, demonstrating powerful demand resilience.

The Yield Era Has Just Begun

Airdrop rewards can spark temporary rallies, but it’s “certainty of yield, deep liquidity, and robust derivatives infrastructure” that truly attract major capital. TradFi supports $600 trillion in rate derivatives; DeFi is far behind, with actual yield trading accounting for less than 3%. Pendle has spent three years methodically filling that 97% gap.

Pendle’s rise proves two points: on-chain platforms can securely clear billions in principal at maturity and maintain sticky capital through downturns; more importantly, Pendle has shifted rate pricing from “closed-door” project management to open on-chain competition where the best survive. As long as there’s yield, someone will create PT/YT, and as long as yields are modularized, Pendle will be the go-to venue. Airdrop and meme cycles may pass, but the rate market is just getting started—buckle up, the show has only reached intermission.

Disclaimer:

- This article is a republication from [BlockBeats], with copyright belonging to the original author [BlockBeats]. For any concerns about this republication, please contact the Gate Learn team for prompt resolution following proper procedures.

- Disclaimer: The views and opinions expressed herein are the author’s alone and do not constitute investment advice.

- This article was translated into other languages by the Gate Learn team. Without specific mention of Gate, no part of this translation may be reproduced, distributed, or plagiarized.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer

Exploration of the Layer2 Solution: zkLink