AxelAdlerJr

No content yet

AxelAdlerJr

GM!

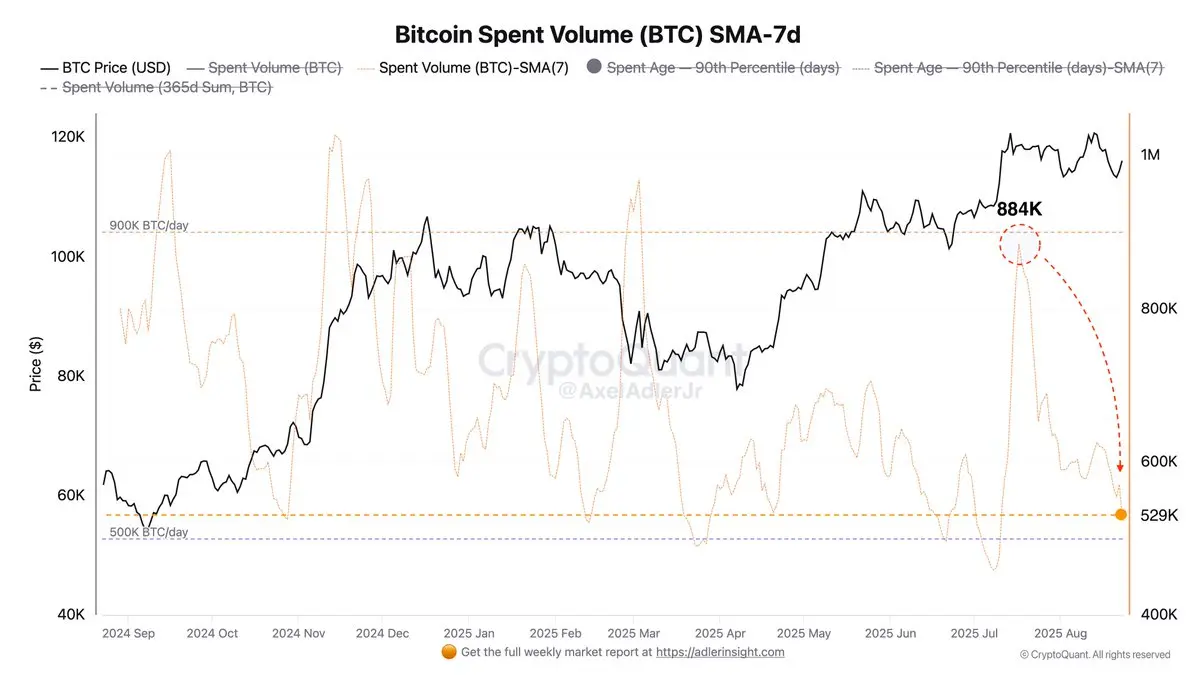

Spent Volume (BTC)- the total volume of coins spent per day. This metric reflects liquidity flow, though it remains sensitive to internal transfers by exchanges and services. This week, its average value dropped to a minimum of 529K BTC per day.

This indicates that the main wave of sellers at current price levels has dried up.

Spent Volume (BTC)- the total volume of coins spent per day. This metric reflects liquidity flow, though it remains sensitive to internal transfers by exchanges and services. This week, its average value dropped to a minimum of 529K BTC per day.

This indicates that the main wave of sellers at current price levels has dried up.

- Reward

- like

- Comment

- Repost

- Share

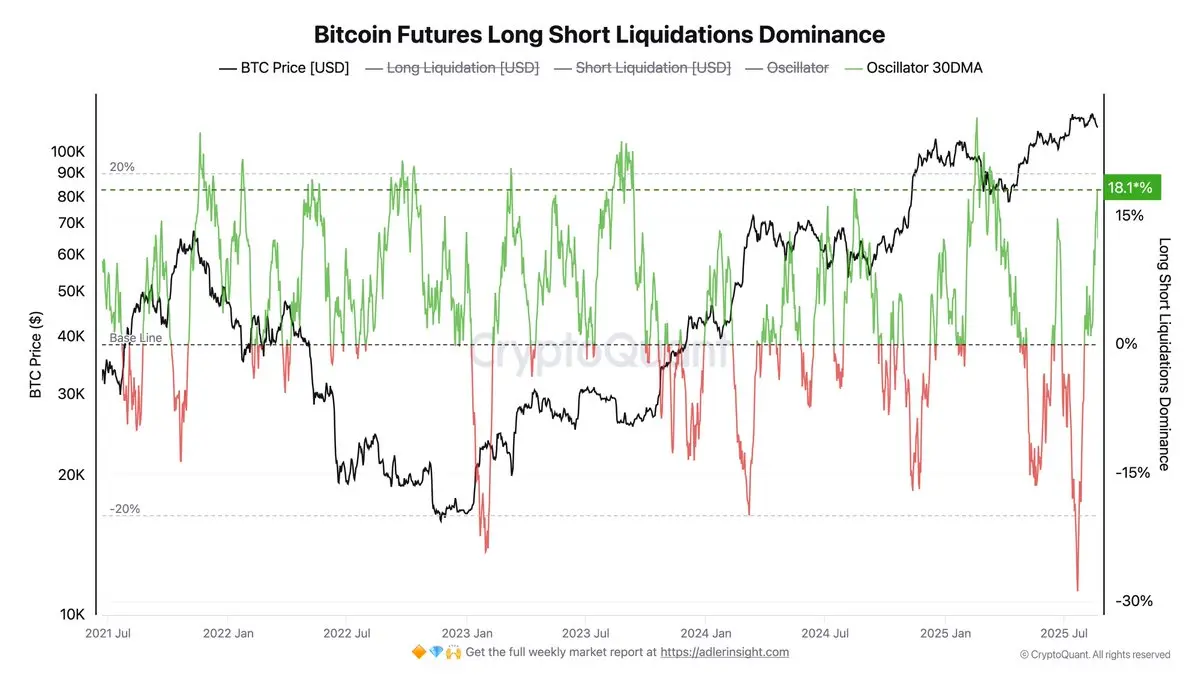

This week the market experienced strong bear pressure, with liquidation dominance shifting into positive territory and accelerating to +18%. Forced closures of long positions dominated throughout the week.

Current metric indicators signal an approaching full deleveraging of bulls, which may begin to form a reversal in the metric.

Current metric indicators signal an approaching full deleveraging of bulls, which may begin to form a reversal in the metric.

- Reward

- like

- Comment

- Repost

- Share

Today the market awaits Federal Reserve Chairman Jerome Powell speech at the Jackson Hole meeting to receive fresh signals regarding policy prospects.

The speech is scheduled for 10 a.m. ET at the Jackson Lake Lodge in Grand Teton National Park, Wyoming.

The speech is scheduled for 10 a.m. ET at the Jackson Lake Lodge in Grand Teton National Park, Wyoming.

IN-7.81%

- Reward

- like

- Comment

- Repost

- Share

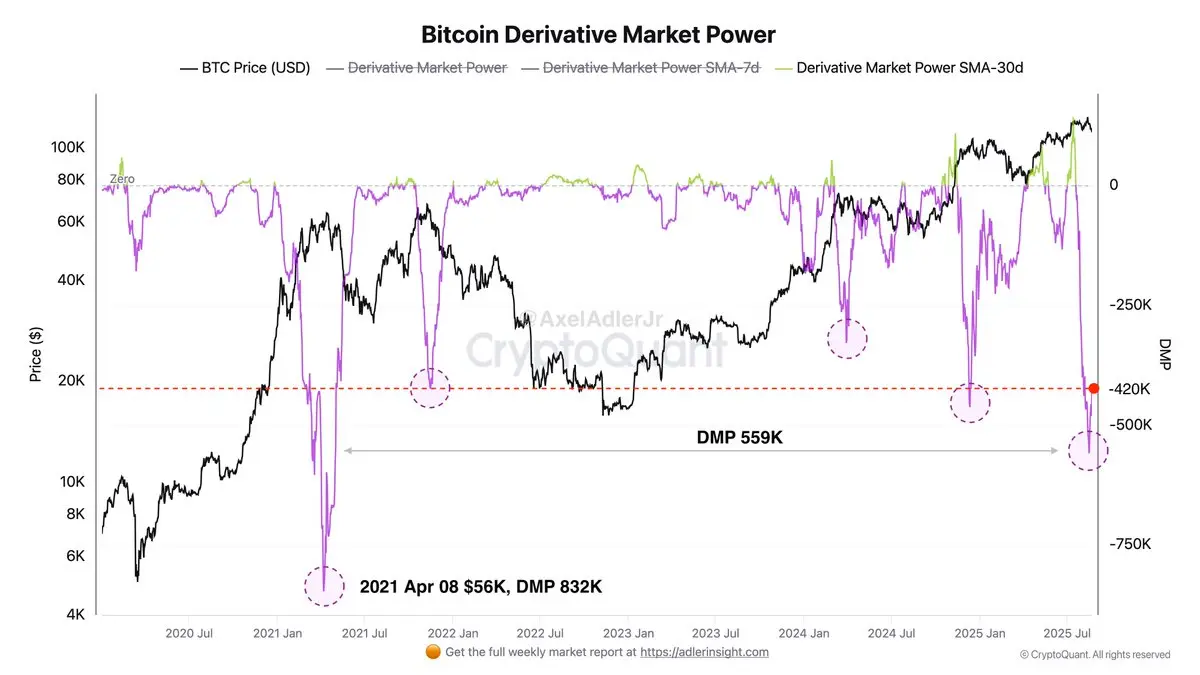

Over the past few days, Derivative Market Power has bounced back from extremely low levels. After crashing to −559K, the index rose to −420K, reflecting the strongest bear pressure since April 2021. This pressure is now gradually easing: funding rates are softening, taker order imbalances are narrowing, and some short positions are being closed.

The index is formed as a daily aggregated value of OI × Funding × Taker-imbalance, where OI is the aggregate open interest in futures, Funding is the weighted average funding rate, and Taker-imbalance is the ratio of net market buy and sell flows.

Thu

The index is formed as a daily aggregated value of OI × Funding × Taker-imbalance, where OI is the aggregate open interest in futures, Funding is the weighted average funding rate, and Taker-imbalance is the ratio of net market buy and sell flows.

Thu

- Reward

- like

- 1

- Repost

- Share

BloodyEagle :

:

Quick, enter a position! 🚗The dollar index has stalled as investors await Federal Reserve Chairman Powells speech at Jackson Hole for clues on the Fed’s next move on interest rates.

MOVE-2.28%

- Reward

- like

- Comment

- Repost

- Share

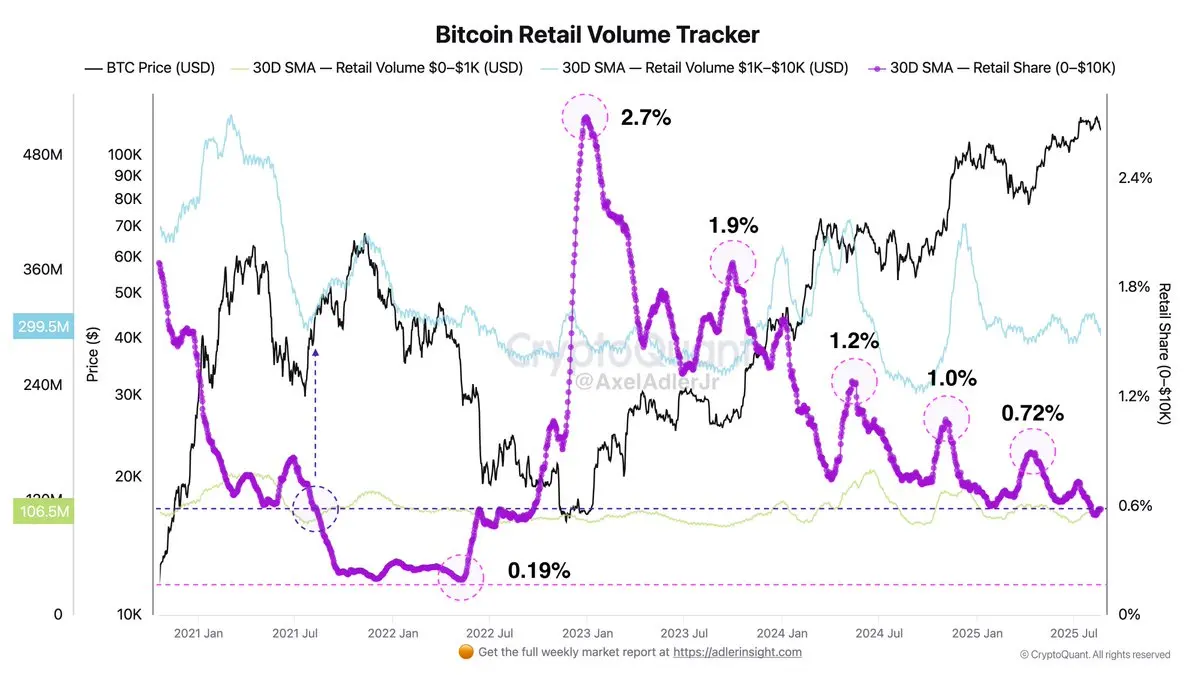

The share of retail transfers $0–$10K in Bitcoin networks total USD turnover has been declining throughout the entire cycle: from a peak of 2.7% to the current 0.6%. At the same time, in absolute terms, activity remains significant at over $400M per day, but this represents only 0.6% of the total volume passing through the network.

Cooling retail demand was previously observed at the end of the bull cycle in autumn 2021, when the indicator fell to a historical minimum of 0.19%.

The decline in retail share in the past coincided with the final phases of bull cycles, which can be interpreted as

Cooling retail demand was previously observed at the end of the bull cycle in autumn 2021, when the indicator fell to a historical minimum of 0.19%.

The decline in retail share in the past coincided with the final phases of bull cycles, which can be interpreted as

- Reward

- 1

- Comment

- Repost

- Share

Gold has been trapped in a sideways range since May this is a consequence of frozen drivers. After the vertical rally to ATH, the market had already priced in the Fed's easing cycle and strong central bank demand. From there, the picture hit a plateau: US real yields and the dollar are constrained, inflation expectations are uncertain, and the pace of rate cuts remains unclear. Under these conditions, gold has neither new upward momentum nor reason for a deep decline.

To break out of the sideways range, a shift in one direction is needed - either deeper and more obvious dollar weakness or a de

To break out of the sideways range, a shift in one direction is needed - either deeper and more obvious dollar weakness or a de

- Reward

- like

- Comment

- Repost

- Share

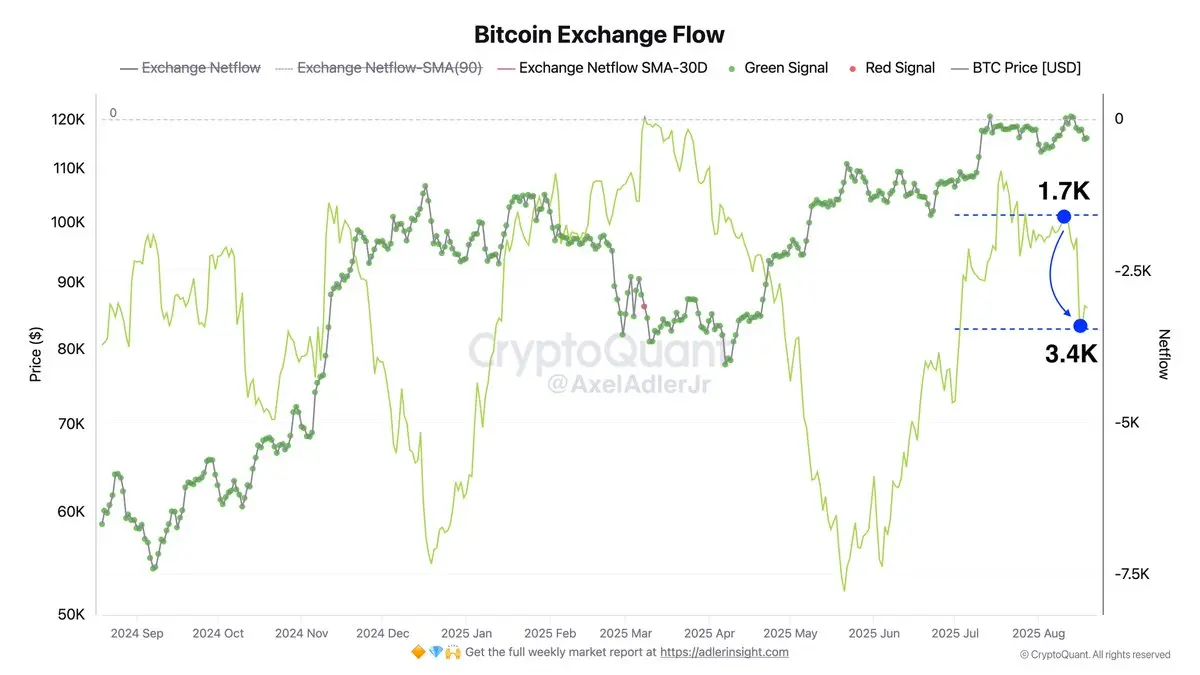

Against the backdrop of price decline, we see strengthening net outflow: the Exchange Netflow-30D moving average became more negative from -1.7K to -3.4K BTC/day. This means coins on CEX exchanges are being bought faster than they are being sold.

Such a shift in a falling market is a bullish divergence, where participants are using the drawdown to buy back coins.

Such a shift in a falling market is a bullish divergence, where participants are using the drawdown to buy back coins.

- Reward

- like

- Comment

- Repost

- Share

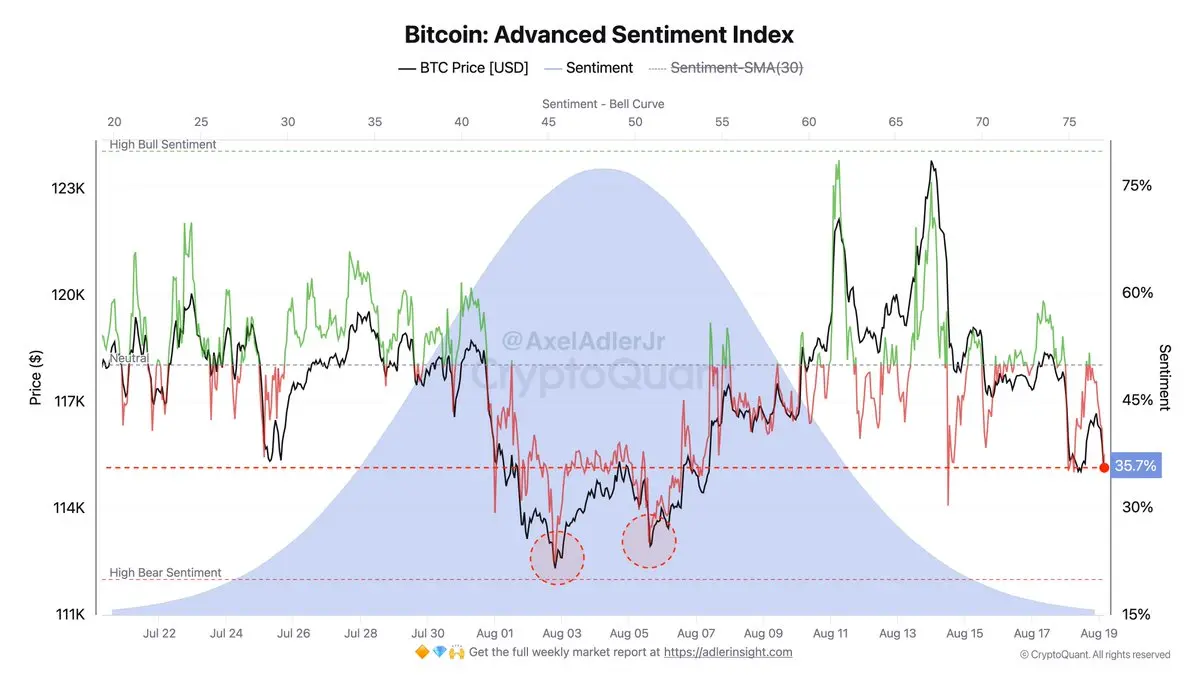

The sentiment index on the futures market has cooled to 36% below the neutral zone. After the spikes on August 11-14, when the metric briefly moved to 70% on price jumps to 123K.

Currently, the price is holding at 115K, while the index momentum is declining: within the index composition, sellers predominate in the short-term moment (negative net-taker and volume-delta) with neutral open interest. This means the market has transitioned from euphoria at the high to a range-trading phase.

Such a profile means that while the index remains below 45-50%, bounces will likely be sold and the price ten

Currently, the price is holding at 115K, while the index momentum is declining: within the index composition, sellers predominate in the short-term moment (negative net-taker and volume-delta) with neutral open interest. This means the market has transitioned from euphoria at the high to a range-trading phase.

Such a profile means that while the index remains below 45-50%, bounces will likely be sold and the price ten

- Reward

- like

- Comment

- Repost

- Share

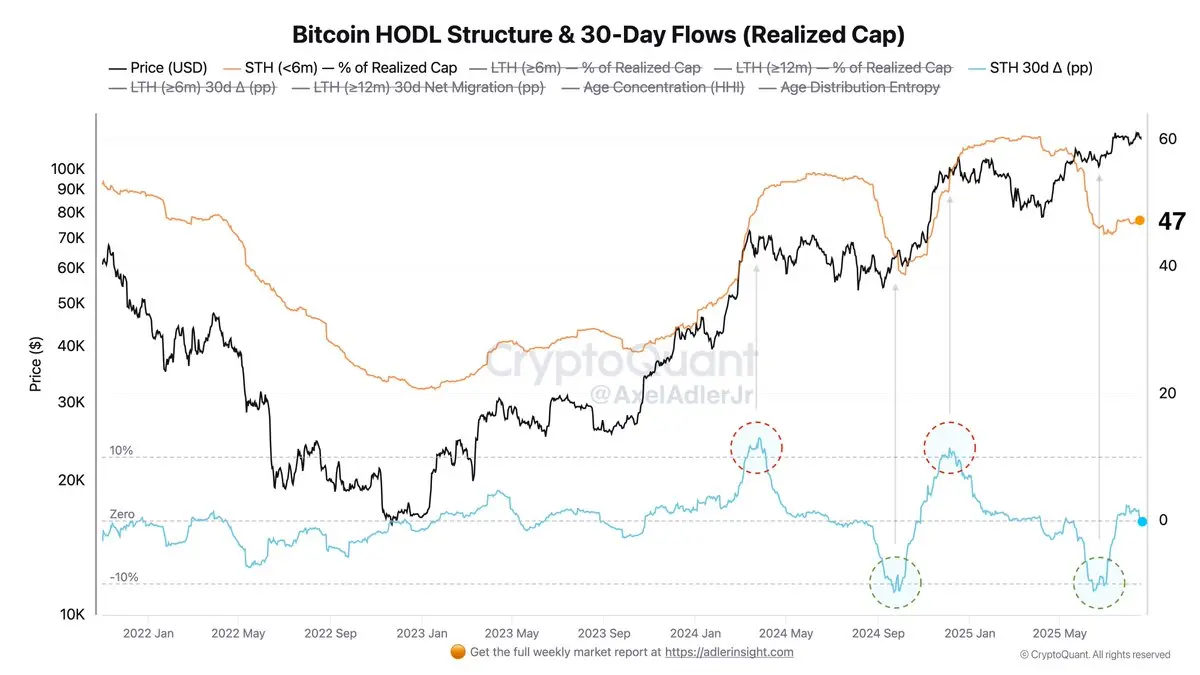

The chart shows the share of STH (<6m) in realized cap (orange line) and its 30-day change STH 30d Δ (blue line).

The blue curve represents the net migration of value toward young coins over the past 30 days. Growth indicates accelerating turnover and distribution from old holders to new ones, while decline indicates coin aging and strengthening of diamond hands.

Currently, the price is at ATH, STH share = 47%, and STH 30d Δ = 0, meaning there has been no notable flow between young and older cohorts over the month.

Spikes in Δ to 10+ percentage points coincided with local overheating and peaks

The blue curve represents the net migration of value toward young coins over the past 30 days. Growth indicates accelerating turnover and distribution from old holders to new ones, while decline indicates coin aging and strengthening of diamond hands.

Currently, the price is at ATH, STH share = 47%, and STH 30d Δ = 0, meaning there has been no notable flow between young and older cohorts over the month.

Spikes in Δ to 10+ percentage points coincided with local overheating and peaks

- Reward

- like

- Comment

- Repost

- Share

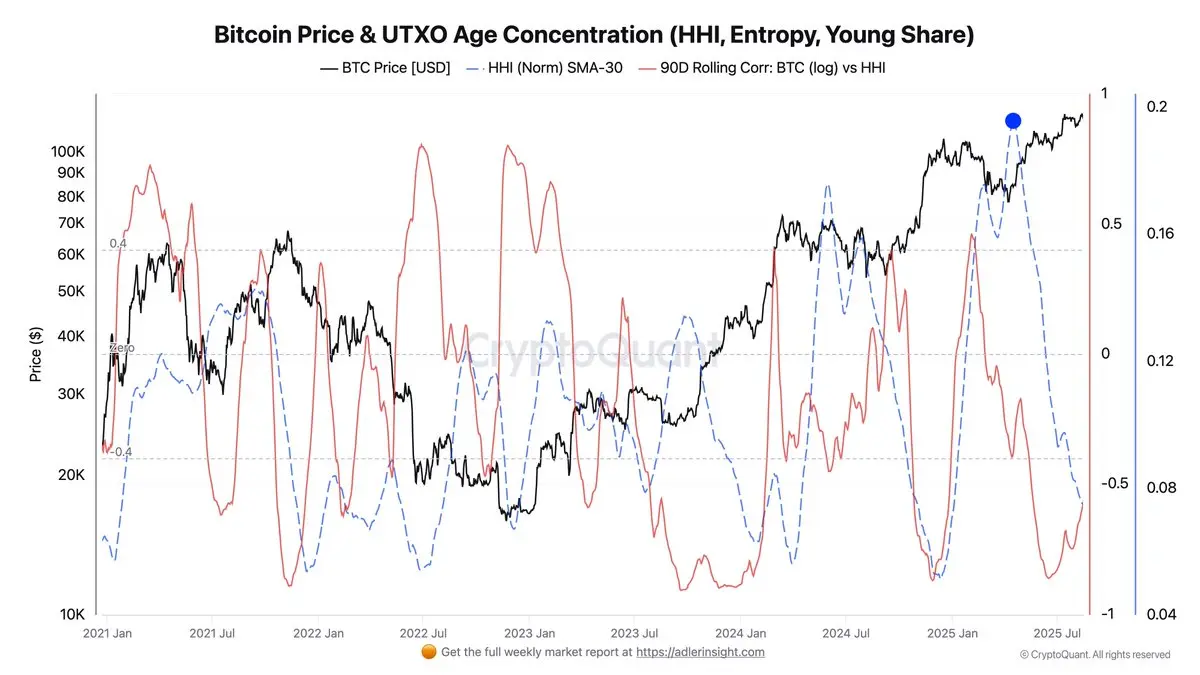

Currently BTC is trading near ATH. The age cohort concentration index (HHI Norm SMA-30) has been declining since April and remains at low levels, while the 90-day correlation of BTC log-price with HHI stays negative (only starting to bounce back after extremely low values).

This combination price growth amid falling concentration - indicates broadening participation across age STH cohorts, which typically makes the trend more sustainable than a narrow rally driven by one or two young buckets.

This combination price growth amid falling concentration - indicates broadening participation across age STH cohorts, which typically makes the trend more sustainable than a narrow rally driven by one or two young buckets.

- Reward

- like

- Comment

- Repost

- Share

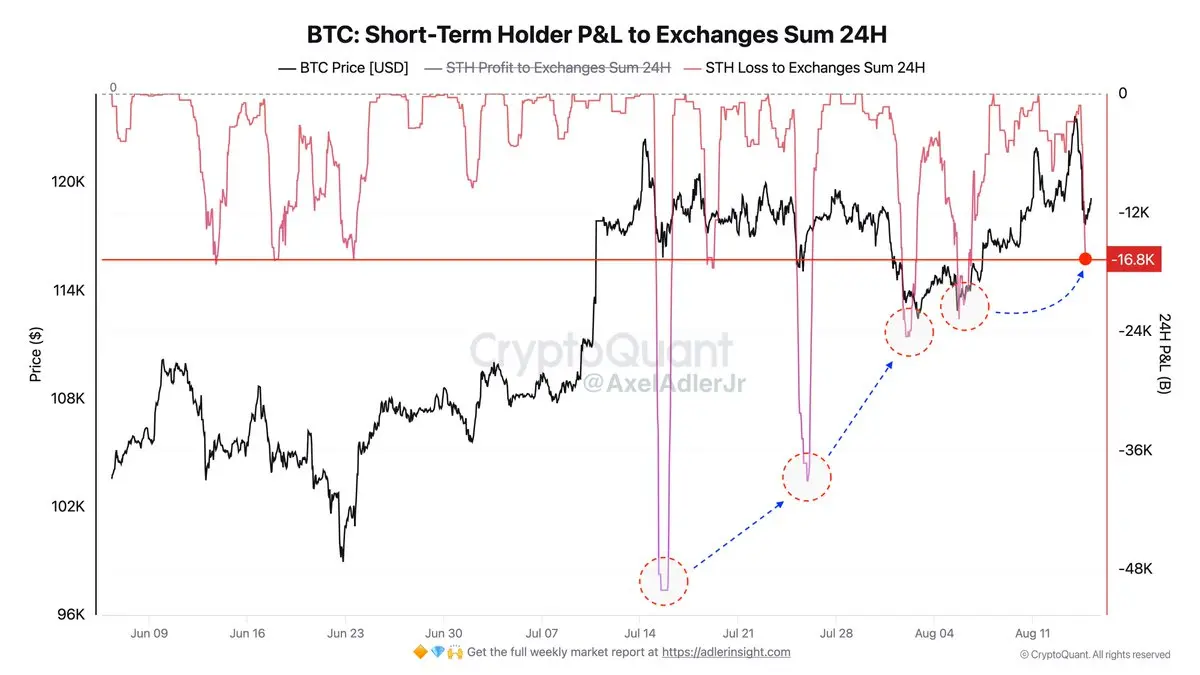

During yesterday's pullback, 16.8K BTC were sent to exchanges at a loss from Short-Term Holders - this is noticeably less than in previous drawdowns. The chart shows a trend of decreasing amplitude of capitulation selling (blue arrows).

This essentially indicates weakening pressure from STH.

This essentially indicates weakening pressure from STH.

- Reward

- like

- Comment

- Repost

- Share

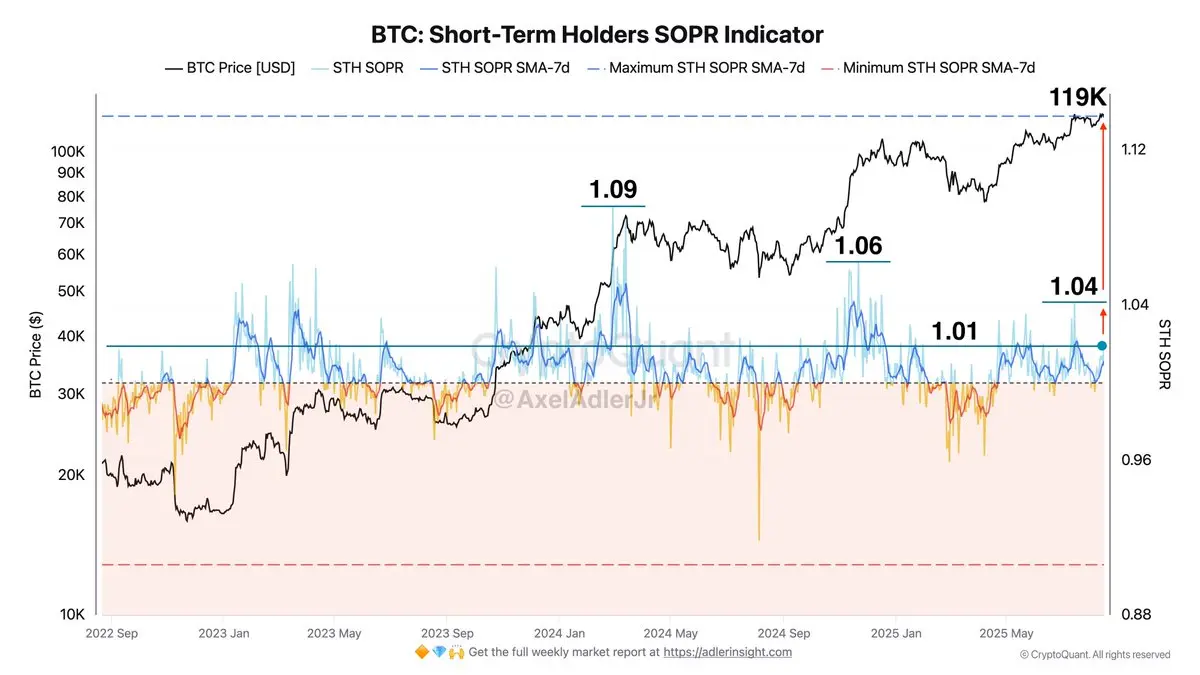

STH SOPR-7d has risen to 1.04 at a price of $119K, meaning short-term holders are on average realizing profits, and the market is absorbing this selling - a bullish sign. The amplitude is still moderate and below the peaks of previous waves 1.06–1.09, so selling pressure from STH is not extreme.

The bullish scenario involves maintaining SOPR-7d > 1.00–1.02 with pullbacks to unity that are quickly bought up.

The indicator moving below 1.0 signals weakening demand and increases the risk of a deeper correction.

The bullish scenario involves maintaining SOPR-7d > 1.00–1.02 with pullbacks to unity that are quickly bought up.

The indicator moving below 1.0 signals weakening demand and increases the risk of a deeper correction.

- Reward

- like

- Comment

- Repost

- Share

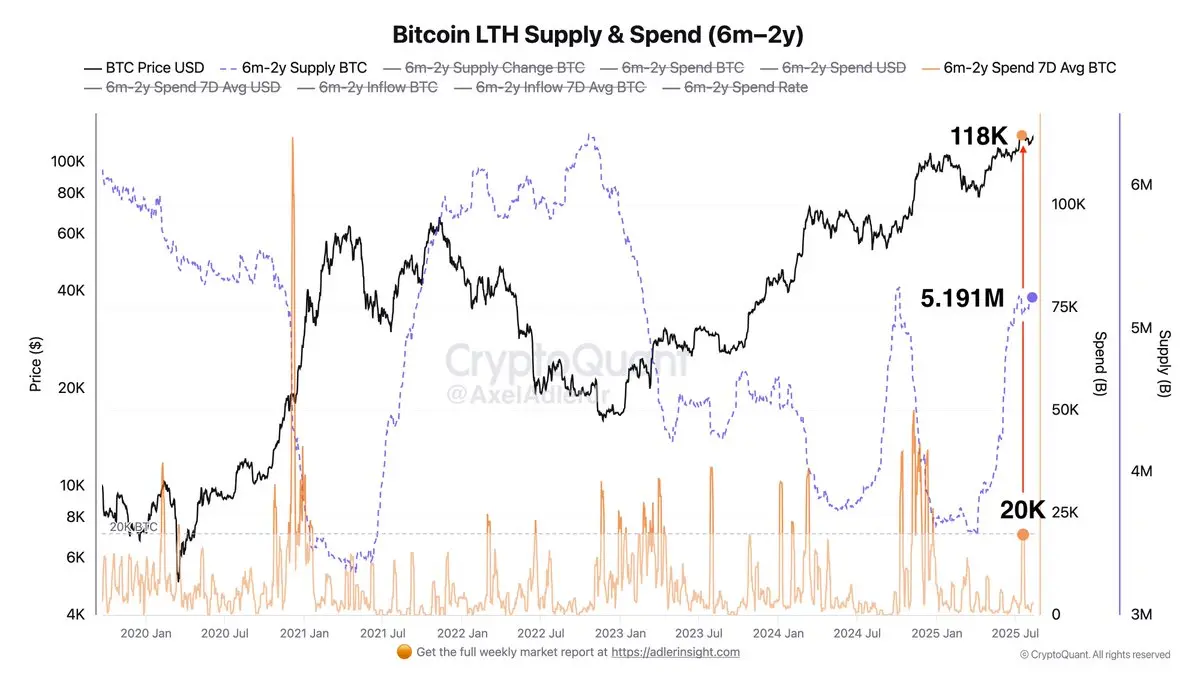

Regarding the accumulation-distribution of the Long-Term Holder cohort holding coins from six months to two years: their supply has risen from 3.551M BTC in April (when the price was $83K) to 5.191M BTC currently (+1.64M BTC). During the ATH test at $118K, there was moderate profit-taking: the cohort's 7-day average spending rose to 20K BTC, which is notably lower than typical spending spikes from the past (40–70K).

In total, this indicates that accumulation is prevailing over distribution among a large number of network participants.

In total, this indicates that accumulation is prevailing over distribution among a large number of network participants.

- Reward

- like

- Comment

- Repost

- Share

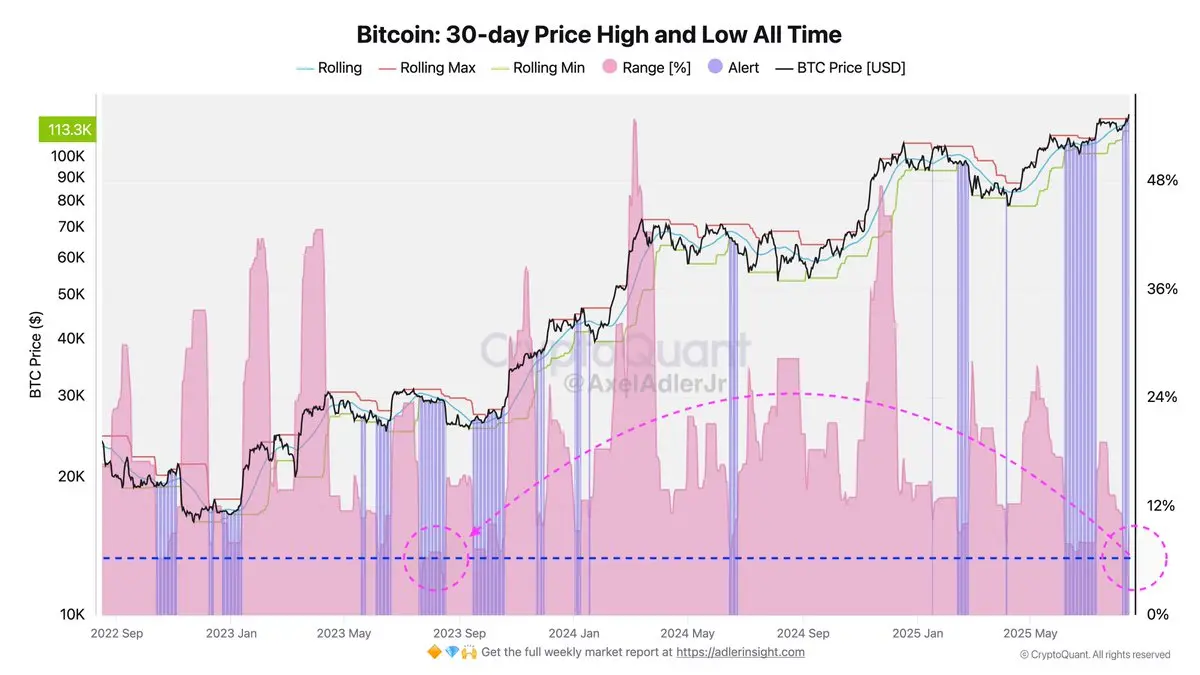

BTC volatility according to the 30-day Price High & Low metric has compressed to a 2-year minimum: the range between the 30-day high and low has narrowed and the bands themselves (rolling max/min) have tightly squeezed the price. Such compression typically reflects supply/demand balance and low realized volatility, when liquidity concentrates above local highs ($120K) and below lows ($113K).

The probability of range expansion is increasing.

The probability of range expansion is increasing.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share