TraderLars

No content yet

TraderLars

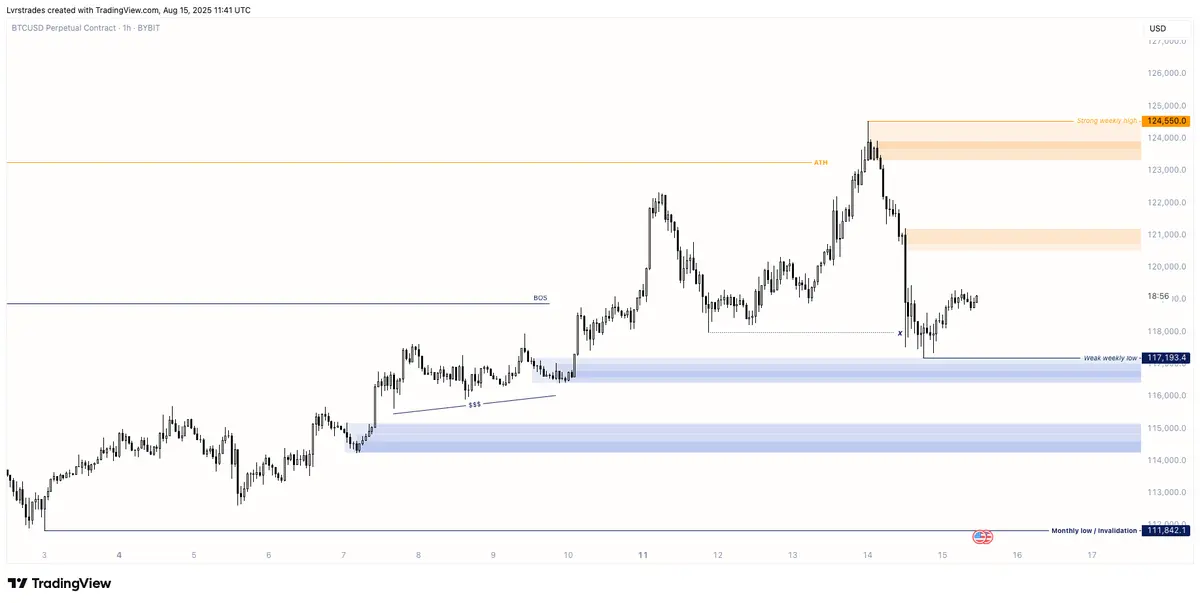

$BTC

📊 New Day, New Data

Lower prices look likely today, but there’s one important detail to keep in mind.

Let’s dive in 👇

Price:

Yesterday we had a big dump, sweeping the weekly high. Statistically, that makes it very unlikely to see new highs this week. That shifts my focus to looking for shorts targeting the weekly low, but I want confirmation first.

The caveat is that this week’s low was formed on Thursday. Normally, Thursday pivot points are weak and rarely hold. But this one came during a news-driven move.

And since news doesn’t really change direction (it just speeds up what was alre

📊 New Day, New Data

Lower prices look likely today, but there’s one important detail to keep in mind.

Let’s dive in 👇

Price:

Yesterday we had a big dump, sweeping the weekly high. Statistically, that makes it very unlikely to see new highs this week. That shifts my focus to looking for shorts targeting the weekly low, but I want confirmation first.

The caveat is that this week’s low was formed on Thursday. Normally, Thursday pivot points are weak and rarely hold. But this one came during a news-driven move.

And since news doesn’t really change direction (it just speeds up what was alre

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$BTC

📊 New Day, New Data

We printed a fresh all-time high, but failed to stay above it. Still, I don’t believe the weekly high is in yet.

Let’s break it down 👇

Price:

Price action remains clean, with supply and demand zones being respected. After tapping a new ATH, Bitcoin rejected and left behind supply.

I expect a retest of that supply before continuing down toward the demand zone around 120K.

If demand is tested first, without retesting supply, price could push even lower in the short term.

Time (weekly):

✅ 7% chance to take out the low

❌ 79% chance to take out the high, if the low holds

📊 New Day, New Data

We printed a fresh all-time high, but failed to stay above it. Still, I don’t believe the weekly high is in yet.

Let’s break it down 👇

Price:

Price action remains clean, with supply and demand zones being respected. After tapping a new ATH, Bitcoin rejected and left behind supply.

I expect a retest of that supply before continuing down toward the demand zone around 120K.

If demand is tested first, without retesting supply, price could push even lower in the short term.

Time (weekly):

✅ 7% chance to take out the low

❌ 79% chance to take out the high, if the low holds

- Reward

- like

- Comment

- Repost

- Share

Stop overcomplicating your charts.

You don’t need 10 indicators, you need a deep understanding of supply & demand.

These zones are where institutions step in. Only they have the size to move price aggressively.

When price revisits them, they may still have unfilled orders or want to defend their previous positions, causing another reaction.

Sometimes zones fail, not because the concept is wrong, but because orders are already filled or market context has shifted.

Cut the noise. Focus on the zones.

You don’t need 10 indicators, you need a deep understanding of supply & demand.

These zones are where institutions step in. Only they have the size to move price aggressively.

When price revisits them, they may still have unfilled orders or want to defend their previous positions, causing another reaction.

Sometimes zones fail, not because the concept is wrong, but because orders are already filled or market context has shifted.

Cut the noise. Focus on the zones.

- Reward

- like

- Comment

- Repost

- Share

$BTC.D is bouncing from a key daily demand zone, so I’m expecting alts to drop 10–20% as we move toward supply.

Base case: expecting a rejection at supply before continuing the way down. That means one final dump on alts, before the real run begins.

But if dominance somehow breaks above the orange line, altcoins probably are heading straight to the gulag.

Base case: expecting a rejection at supply before continuing the way down. That means one final dump on alts, before the real run begins.

But if dominance somehow breaks above the orange line, altcoins probably are heading straight to the gulag.

- Reward

- like

- Comment

- Repost

- Share

$BTC

📊 New Day, New Data

Massive pump into the final supply zone before potential new all-time highs.

Here’s what I’m watching next 👇

Price:

Bitcoin remains strong, leaving many traders on the sidelines. We just swept all resting liquidity and created a large CME gap on the way up, while also leaving behind fresh demand zones.

Monthly outlook stays very bullish, with data showing a 90% chance of hitting 131K in August.

Time (monthly):

✅ 23% chance to take out the monthly low

❌ 90% chance to form a new high, if the low holds

➡️Bias: bullish

Both daily and weekly time-based stats don't offer a

📊 New Day, New Data

Massive pump into the final supply zone before potential new all-time highs.

Here’s what I’m watching next 👇

Price:

Bitcoin remains strong, leaving many traders on the sidelines. We just swept all resting liquidity and created a large CME gap on the way up, while also leaving behind fresh demand zones.

Monthly outlook stays very bullish, with data showing a 90% chance of hitting 131K in August.

Time (monthly):

✅ 23% chance to take out the monthly low

❌ 90% chance to form a new high, if the low holds

➡️Bias: bullish

Both daily and weekly time-based stats don't offer a

- Reward

- like

- Comment

- Repost

- Share

Every candle you see is a story of unbalanced orders.

Some stories are finished.

Most are not.

Price always returns to the unfinished ones.

Sometimes hours later.

Sometimes years.

This is why patience is the only real edge.

Supply and demand isn’t about zones.

It’s about memory.

The market never forgets.

Some stories are finished.

Most are not.

Price always returns to the unfinished ones.

Sometimes hours later.

Sometimes years.

This is why patience is the only real edge.

Supply and demand isn’t about zones.

It’s about memory.

The market never forgets.

- Reward

- like

- Comment

- Repost

- Share

$BTC

📊 New Day, New Data

New weekly highs, but supply and demand on both sides... Let's see what could be next 👇

Price:

Market structure remains beautifully bullish, with levels being respected well. Price is now approaching the first major resistance zone.

We created valid supply during the Asia session, but there are weak highs and a main POI sitting above. This could easily serve as an inducement, where many short stops are stacked around the daily high.

Time (weekly):

✅1,1% chance to take out the weekly low

⚠️ 64% chance to form a new high, if the low holds

➡️ Bias: bullish

Time (daily):

📊 New Day, New Data

New weekly highs, but supply and demand on both sides... Let's see what could be next 👇

Price:

Market structure remains beautifully bullish, with levels being respected well. Price is now approaching the first major resistance zone.

We created valid supply during the Asia session, but there are weak highs and a main POI sitting above. This could easily serve as an inducement, where many short stops are stacked around the daily high.

Time (weekly):

✅1,1% chance to take out the weekly low

⚠️ 64% chance to form a new high, if the low holds

➡️ Bias: bullish

Time (daily):

- Reward

- like

- Comment

- Repost

- Share

$BTC

Quick update before we head into the New York Session. Here is everything you need to know for the Monthly, Weekly and Daily data.

Monthly bias: neutral

Time-based:

⚠️ 41% chance to take out the low

❌ 96% chance to put in a new high, if the low holds

Distance-based:

⚠️ 46% chance to take out the low

❌ 100% chance for more displacement

Confidence targets for bullish scenario:

90% of months would reach 131.339

50% of months would reach 147.307

Weekly bias: bullish

Time-based:

✅ 4% chance to take out the low

❌ 75% chance to put in a new high, if the low holds

Distance-based:

⚠️ 36% chance to

Quick update before we head into the New York Session. Here is everything you need to know for the Monthly, Weekly and Daily data.

Monthly bias: neutral

Time-based:

⚠️ 41% chance to take out the low

❌ 96% chance to put in a new high, if the low holds

Distance-based:

⚠️ 46% chance to take out the low

❌ 100% chance for more displacement

Confidence targets for bullish scenario:

90% of months would reach 131.339

50% of months would reach 147.307

Weekly bias: bullish

Time-based:

✅ 4% chance to take out the low

❌ 75% chance to put in a new high, if the low holds

Distance-based:

⚠️ 36% chance to

- Reward

- like

- Comment

- Repost

- Share

$BTC

Quick update before we head into the New York Session. Here is everything you need to know for the Monthly, Weekly and Daily data.

Monthly bias: neutral

Time-based:

⚠️ 41% chance to take out the low

❌ 96% chance to put in a new high, if the low holds

Distance-based:

⚠️ 46% chance to take out the low

❌ 100% chance for more displacement

Confidence targets for bullish scenario:

90% of months would reach 131.339

50% of months would reach 147.307

Weekly bias: bullish

Time-based:

✅ 4% chance to take out the low

❌ 75% chance to put in a new high, if the low holds

Distance-based:

⚠️ 36% chance to

Quick update before we head into the New York Session. Here is everything you need to know for the Monthly, Weekly and Daily data.

Monthly bias: neutral

Time-based:

⚠️ 41% chance to take out the low

❌ 96% chance to put in a new high, if the low holds

Distance-based:

⚠️ 46% chance to take out the low

❌ 100% chance for more displacement

Confidence targets for bullish scenario:

90% of months would reach 131.339

50% of months would reach 147.307

Weekly bias: bullish

Time-based:

✅ 4% chance to take out the low

❌ 75% chance to put in a new high, if the low holds

Distance-based:

⚠️ 36% chance to

- Reward

- like

- Comment

- Repost

- Share

$BTC

Nice bounce from demand during New York Open. I expect we take out the weak session high next.

Nice bounce from demand during New York Open. I expect we take out the weak session high next.

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$BTC

📊 New Day, New Data

We could be printing the weekly low today. Let’s take a look at what’s setting up 👇

Price:

We saw a clean rejection from the supply POI we marked out yesterday, and price is now heading toward the demand POI below.

As mentioned in yesterday’s update, I’m still expecting a retest of demand before continuation higher. So far, that’s playing out as expected.

Time (daily):

⚠️ 35% chance of take out the high

❌ 98% chance to put in a new low, if the high holds

➡️ Bias: slight bearish

Distance (daily):

✅ 27% chance to take out the daily high

❌ 99% chance for more displaceme

📊 New Day, New Data

We could be printing the weekly low today. Let’s take a look at what’s setting up 👇

Price:

We saw a clean rejection from the supply POI we marked out yesterday, and price is now heading toward the demand POI below.

As mentioned in yesterday’s update, I’m still expecting a retest of demand before continuation higher. So far, that’s playing out as expected.

Time (daily):

⚠️ 35% chance of take out the high

❌ 98% chance to put in a new low, if the high holds

➡️ Bias: slight bearish

Distance (daily):

✅ 27% chance to take out the daily high

❌ 99% chance for more displaceme

- Reward

- 4

- 2

- Repost

- Share

GateUser-4a8b4621 :

:

we dont need to take this shit, we are all free to leave a platform who think we are stupid enought to let them steel OUR MONEY 😡😡😡😡😡 They tell us delisting, we know better,we are not stupid😏 Delisting = steeling OUR MONEY

View More

$BTC

📊 New Day, New Data

We’ve got weak pivot points on both sides, which adds some complexity to the outlook.

Let’s break it down 👇

Price:

We saw a solid bounce from demand over the weekend, and it did leave behind a clean-looking demand zone.

That said, because it was formed during weekend price action, I’m approaching it with some caution — these zones tend to be less significant in terms of holding power.

Time (monthly):

❌ 70% chance to take out the monthly high

❌ 100% chance to put in a new low if the high holds

⚠️ 90% of monthly highs form after the current high

➡️ Bias: Bullish

Time (

📊 New Day, New Data

We’ve got weak pivot points on both sides, which adds some complexity to the outlook.

Let’s break it down 👇

Price:

We saw a solid bounce from demand over the weekend, and it did leave behind a clean-looking demand zone.

That said, because it was formed during weekend price action, I’m approaching it with some caution — these zones tend to be less significant in terms of holding power.

Time (monthly):

❌ 70% chance to take out the monthly high

❌ 100% chance to put in a new low if the high holds

⚠️ 90% of monthly highs form after the current high

➡️ Bias: Bullish

Time (

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$BTC

📊 New Day, New Data

We’ve swept the weekly low, and with that, we now have a weekly low set on a Friday, which, as we know, tends to be more reliable as a pivot.

Let's see what could be next👇

Price:

Price tapped into the demand zone near the weekly low and is now attempting a reaction.

Lower timeframe structure is bearish, however, we now have a confirmed 1-hourly RSI divergence, suggesting we could see a relief pump during the New York session.

Possibly towards new daily highs or even the 118K supply zone, where rejection is likely.

That said, we’re still in an environment where furthe

📊 New Day, New Data

We’ve swept the weekly low, and with that, we now have a weekly low set on a Friday, which, as we know, tends to be more reliable as a pivot.

Let's see what could be next👇

Price:

Price tapped into the demand zone near the weekly low and is now attempting a reaction.

Lower timeframe structure is bearish, however, we now have a confirmed 1-hourly RSI divergence, suggesting we could see a relief pump during the New York session.

Possibly towards new daily highs or even the 118K supply zone, where rejection is likely.

That said, we’re still in an environment where furthe

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Every loss hides a pattern.

Only data reveals it.

Only data reveals it.

EVERY-0.82%

- Reward

- like

- Comment

- Repost

- Share

$BTC

📊 New Day, New Data

Bounced from the last demand POI, but statistically speaking, the weekly low is weak.

Let's see what could be next 👇

Price:

Very strong and aggressive bounce from our demand POI, which is exactly what you want to see for bullish continuation. Leaving some good new lower timeframe demand POI's in the process.

We took out yesterdays high and rejected at the most refined supply. I'm expecting a rotation here towards the daily lows to find support from there.

We do have some conflicting data, so let's have a look at statistics.

Time:

/weekly

✅ 8% chance to take out the

📊 New Day, New Data

Bounced from the last demand POI, but statistically speaking, the weekly low is weak.

Let's see what could be next 👇

Price:

Very strong and aggressive bounce from our demand POI, which is exactly what you want to see for bullish continuation. Leaving some good new lower timeframe demand POI's in the process.

We took out yesterdays high and rejected at the most refined supply. I'm expecting a rotation here towards the daily lows to find support from there.

We do have some conflicting data, so let's have a look at statistics.

Time:

/weekly

✅ 8% chance to take out the

- Reward

- like

- Comment

- Repost

- Share